Qualified Business Income Deduction Simplified Worksheet 2018 This worksheet is for taxpayers who. Qualified business income deduction part i overview.

Section 199a Deduction Qbi And Retirement Accounts White Coat Investor

You are not a patron in a specified agricultural or horticultural cooperative.

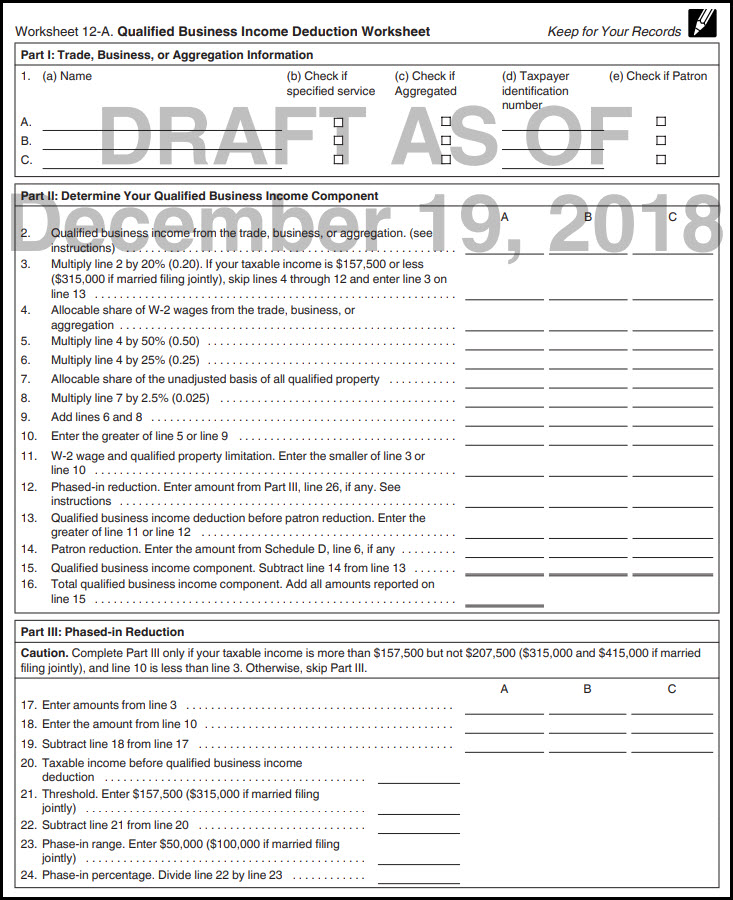

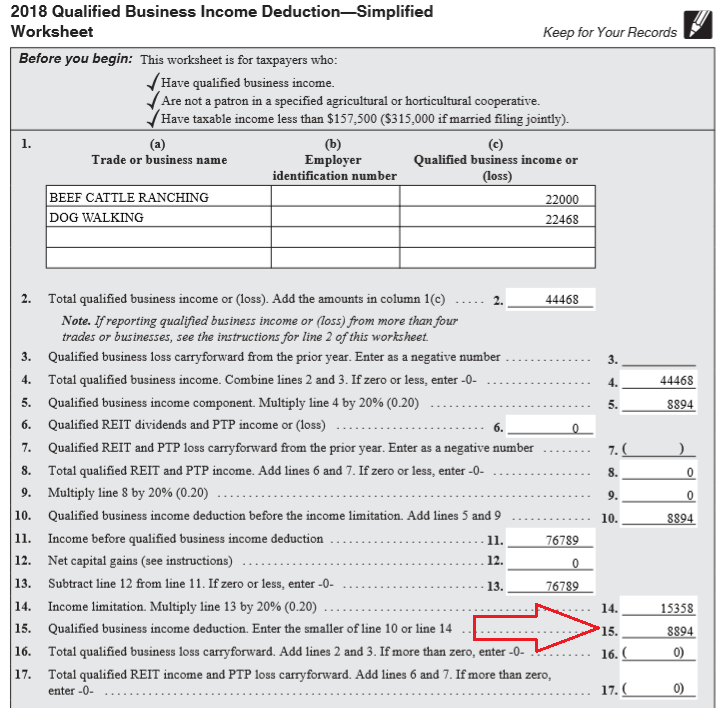

2018 qualified business income deduction simplified worksheet. 2018 Qualified Business Income Deductionsimplified Worksheet 4th Grade Math Packet With Answer Key 2nd Grade Common Core Math Worksheets Alphabet Practice Sheets 5th Grade Printable Worksheets Making Predictions Worksheets 4th Grade multiplying matrices worksheet 4th grade multiplication problems area of a trapezoid worksheet rotation worksheet segment bisector worksheet. Many owners of sole proprietorships partnerships S corporations and some trusts and estates may be eligible for a qualified business income QBI deduction also called Section 199A for tax years beginning after December 31 2017. You have successfully completed this document.

1 a Trade or business name b. With Section 199A of the Trump tax reform the Tax Cuts and Jobs Act of 2017 small business owners may be eligible to take a 20 tax deduction off their pro. Section 199A qualified business income.

Use the worksheet and the instructions in Pub. The deduction is referred to alternatively as the qualified business income QBI deduction the 199A deduction the 20. This document is locked as it has been sent for signing.

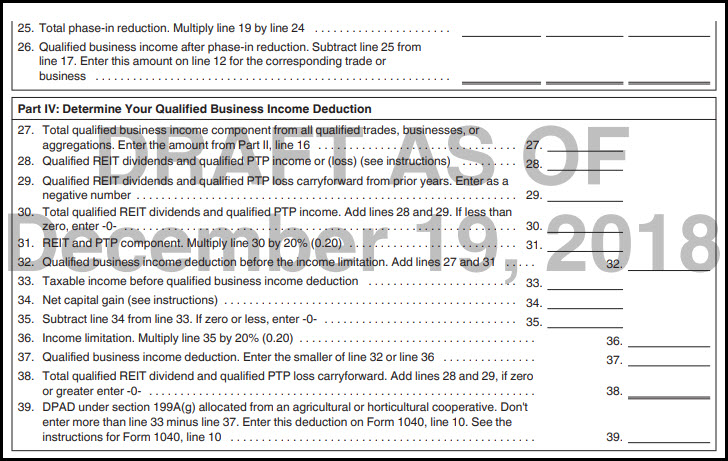

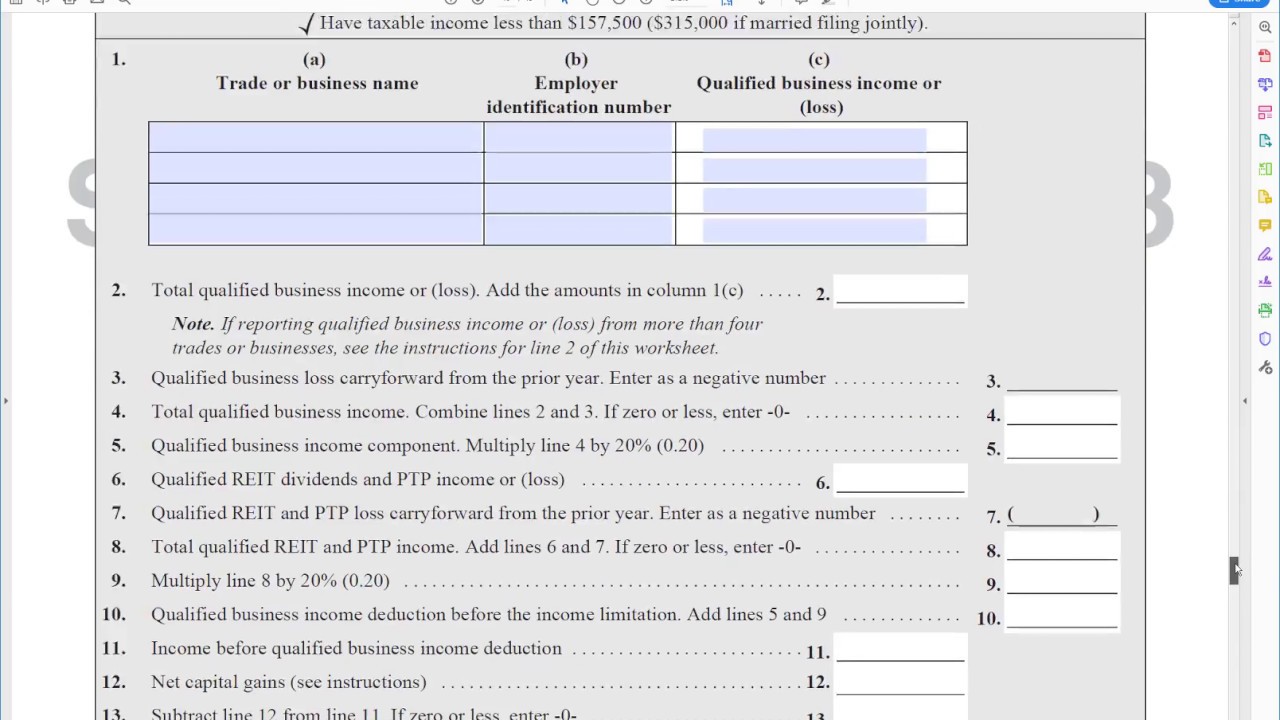

535 if you do not meet all three of these requirements. For 2018 the IRS did not issue a tax form for taxpayers to compute the IRC Section 199A qualified business income deduction. I the deductible amount for each qualified trade or business of the taxpayer defined as the lesser of a 20 of the taxpayers QBI or b the greater of two W-2 wage limits one of which also looks to the unadjusted basis of certain tangible depreciable qualified property.

Dependents Qualifying Child for Child Tax Credit and Credit for Other Dependents. 2018 Qualified Business Income Deduction - Simplified Worksheet. It is very easy to get started making passive 2018 qualified business income deductionsimplified worksheet online.

This worksheet is for taxpayers who. Total Income and Adjusted Gross Income. Form 1040 Social Security Benefits Worksheet IRS 2018.

In this business it is important to remember that the more effort you put into it the more you get out. Other parties need to complete fields in the document. Are not a patron in a specified agricultural or horticultural cooperative.

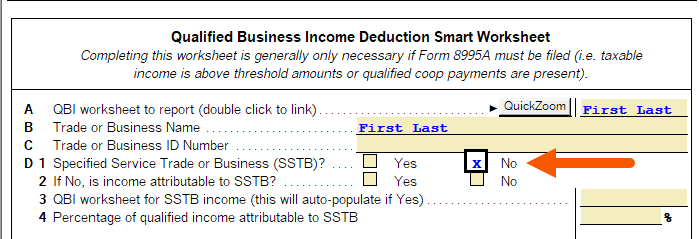

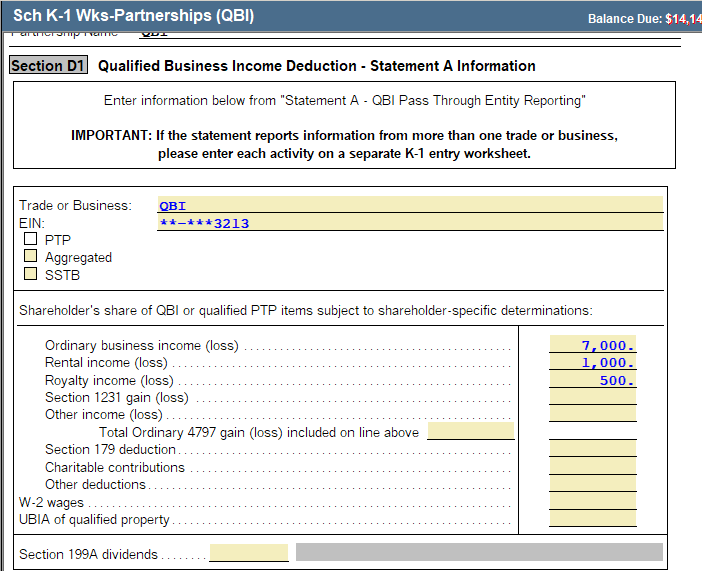

With a little research and a willingness to do what it takes to succeed you will see amazing results. Use Qualified Business Income Deduction - Simplified Worksheet included in the Instructions for Form 1040 if. New for Tax Year 2018 Lacerte - Qualified Business Income QBI Defined.

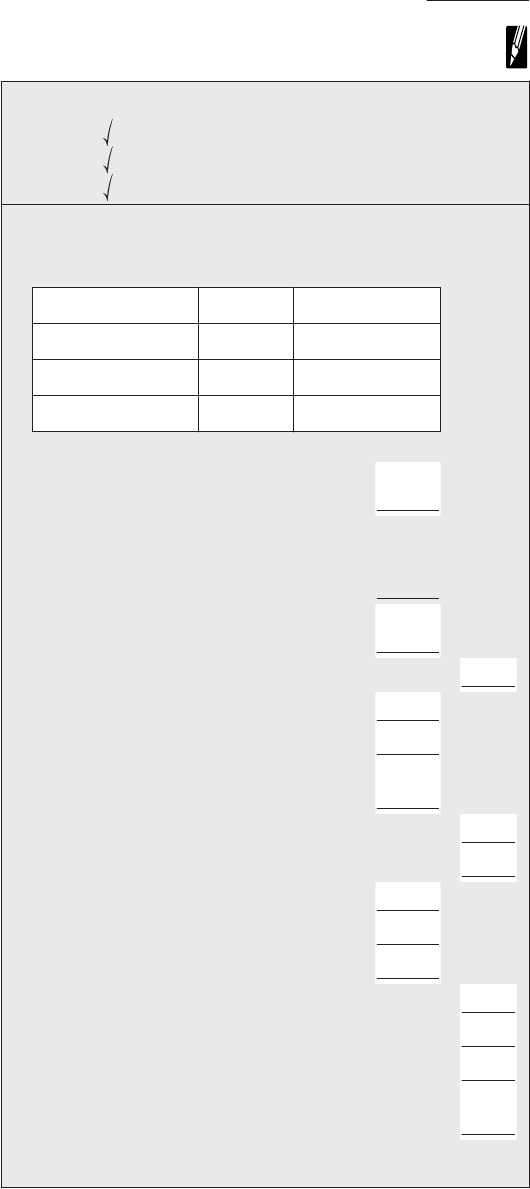

Lacerte QBI Simplified Worksheet. IRS Form 1040 Qualified Business Income Deduction Simplified Worksheet 2018. Have taxable income of 157500 or less 315000 or less if married filing jointly Have any business income even from an SSTB REIT dividends or PTP income.

The TCJA introduced a new deduction available to taxpayers with qualifying business income. 40000 business profit 2826 one half of Social SecurityMedicare tax 37174. Some taxpayers were able to use the worksheet 2018 qualified business income deduction simplified worksheet in the instructions to the 2018 form 1040.

Qualified Business Income 199A - Specified Service Trade or Business SSTB Lacerte product content. At this time the IRS has released only one draft of this form and states that it is not ready for filing. Some taxpayers were able to use the worksheet 2018 Qualified Business Income Deduction-Simplified Worksheet in the Instructions to the 2018.

2018 Simplified - Displaying top 8 worksheets found for this concept. You have qualified business income defined below Your 2018 taxable income does not exceed 157500 315000 if married filing jointly and. IRS Form 1040 Qualified Business Income Deduction Simplified Worksheet 2018.

2018 qualified business income deduction simplified worksheet irs The qualified business income QBI deduction also known as Section 199A allows owners of pass-through businesses to claim a tax deduction worth up to 20 percent of their qualified business income. Line Instructions for Form 1040. It is first available in tax years beginning after December 31 2017 starting in 2018 for calendar year taxpayers.

The draft forms are Form 8995 Qualified Business Income Deduction Simplified Computation and Form 8995-A Qualified Business Income Deduction. It was introduced as part of the 2017 Tax Cuts and Jobs Act. Social Security Number SSN Presidential Election Campaign Fund.

Some of the worksheets for this concept are 2018 qbi deduction simplified work Qualified business income deduction simplified work Qualified business income or september 26 2018 Form 1099 r simplified method 2018 instructions for form 8829 1 of 32 1427 Name 2017 form 1040lines 16a and 16b keep. Form 1040 2018 Foreign Earned Income Tax Worksheet line 11a. IRS Form 1040 Qualified Business Income Deduction Simplified Worksheet 2018.

Where To Report Certain Items From 2018 Forms W-2 1095 1097 1098 and 1099. This is your Qualified Business Income Deduction finally. It is first available in tax years beginning after december 31 2017 starting in 2018 for calendar year taxpayers.

2018 Tax Reform - Qualified Business Income QBI Deduction. Qualified business income deduction simplified worksheet 2018 You can use Form 8995 Special Business Income Discount Simplified Calculation to calculate and report your QBI discount. You will recieve an email notification when the document has been completed by all parties.

Form 1040 2018 Foreign Earned Income Tax Worksheet line 11a. Form 1040 2018 Simplified Method Worksheet lines 4a 4b. Form 1040 2018 Child Tax Credit and Credit for Other Dependents Worksheet line 12a.

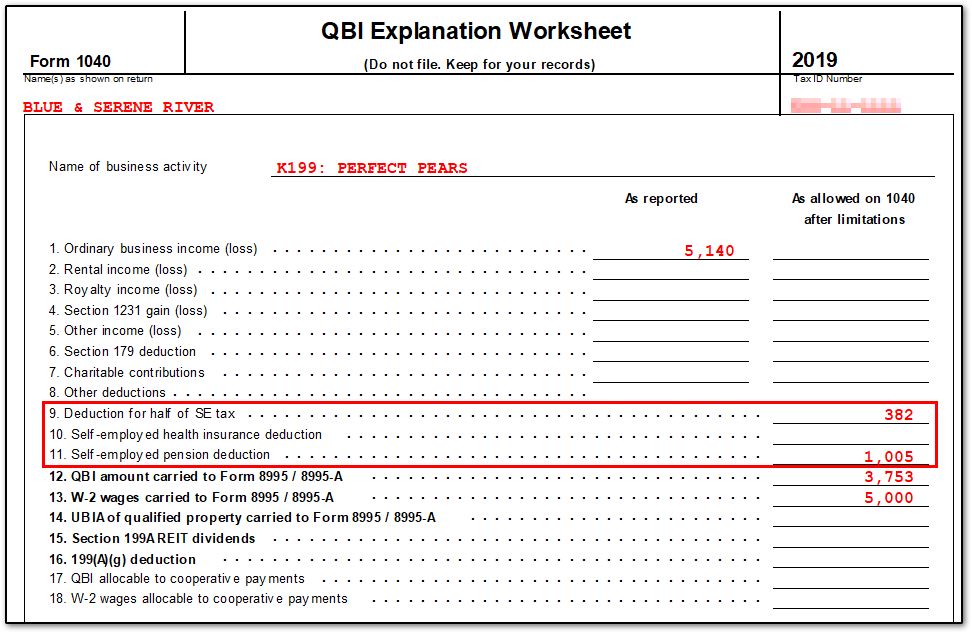

2018 QBI Reduced by Self Employment Tax Health Insurance and Retirement Contribution Deductions. The qualified business income QBI deduction allows you to deduct up to 20 percent of your QBI.

Https Www Irs Gov Pub Irs Utl 2019ntf 01 Pdf

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Proconnect Tax Online Complex Worksheet Section 19 Intuit Accountants Community

Fill Free Fillable Irs Form 1040 Qualified Business Income Deduction Simplified Worksheet 2018 Pdf Form

How To Use The New Qualified Business Income Deduction Worksheet For 2018 Youtube

How To Use The New Qualified Business Income Deduction Worksheet For 2018 Youtube

Proconnect Tax Online Complex Worksheet Section 19 Intuit Accountants Community

Instructions For Form 8995 2020 Internal Revenue Service

Https Www Irs Gov Pub Irs Utl 2019ntf 01 Pdf

Section 199a Deduction Qbi And Retirement Accounts White Coat Investor

Https Www Irs Gov Pub Newsroom Tcja Training Provision 11011 Qbid Pdf

How To Enter And Calculate The Qualified Business Intuit Accountants Community

Qualified Business Income Deduction Example

How To Enter And Calculate The Qualified Business Intuit Accountants Community

Https Go Nccpap Org Higherlogic System Downloaddocumentfile Ashx Documentfilekey 9da121c3 6aec 4b0a B4c8 C65a7cf087c1

Section 199a Deduction Qbi And Retirement Accounts White Coat Investor

Instructions For Form 8995 2020 Internal Revenue Service

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Https Exactax Com Documents Workshops 2018 20exactax 20workshop Pdf

No comments:

Post a Comment